do nonprofits pay taxes on investment income

Ad Discover Why Endowments And Foundations Trust Vanguard. Tax treatment for non-profits.

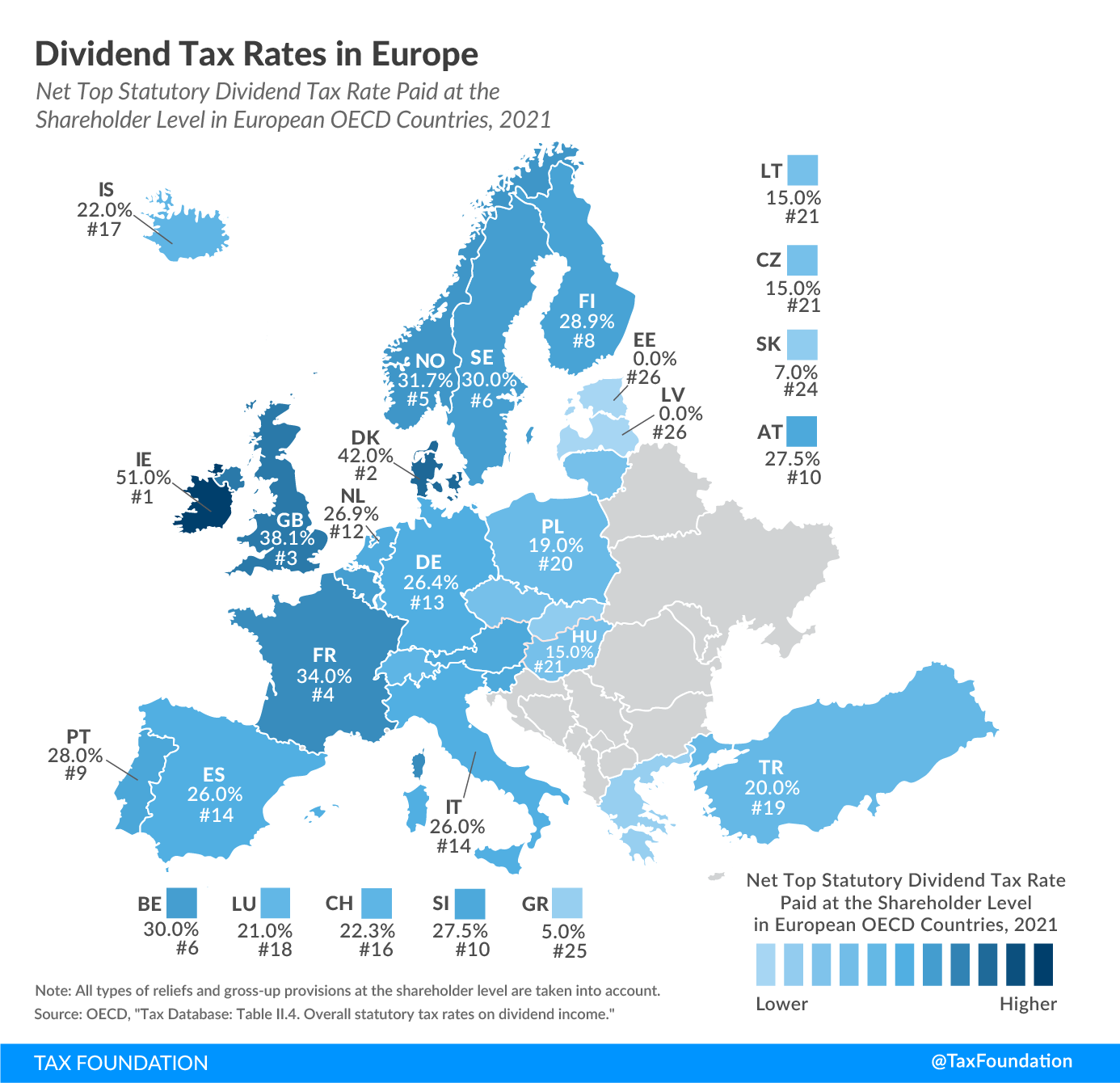

Dividend Tax Rates In Europe 2021 Dividend Tax Rates Rankings

While most US.

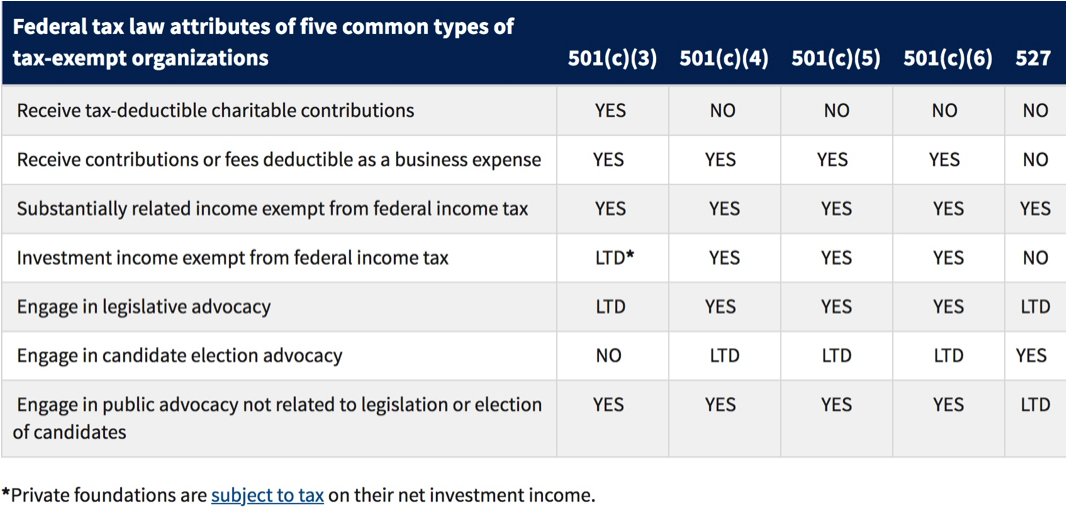

. 20 2019 the excise tax is 2 percent of net. Do nonprofits pay tax on investment income. Your recognition as a 501 c 3 organization exempts you from federal income tax.

Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation. Ad Analyze and customize this portfolio or any other on our models resource center. Ad Answer Simple Questions About Your Life And We Do The Rest.

Do nonprofits pay taxes on. When your nonprofit incurs debt to acquire an income-producing. Entities organized under Section 501 c 3 of the.

Bonfire Prints Ships Your Orders. Entities organized under Section 501c3 of. You Receive 100 of Profits.

For tax years beginning on or before Dec. Do nonprofits pay tax on investment income. Do nonprofits pay taxes on investment income.

Fiduciary Support That Frees You Up To Focus On What Matters MostAdvancing Your Mission. Up to 25 cash back Sometimes nonprofits make money in ways that arent related to their. Fundraising proceeds arent considered a taxable source of income by the IRS.

You Receive 100 of Profits. Below well detail two scenarios in which nonprofits pay tax on investment income. Ad Powerful Fundraising Features for Nonprofits.

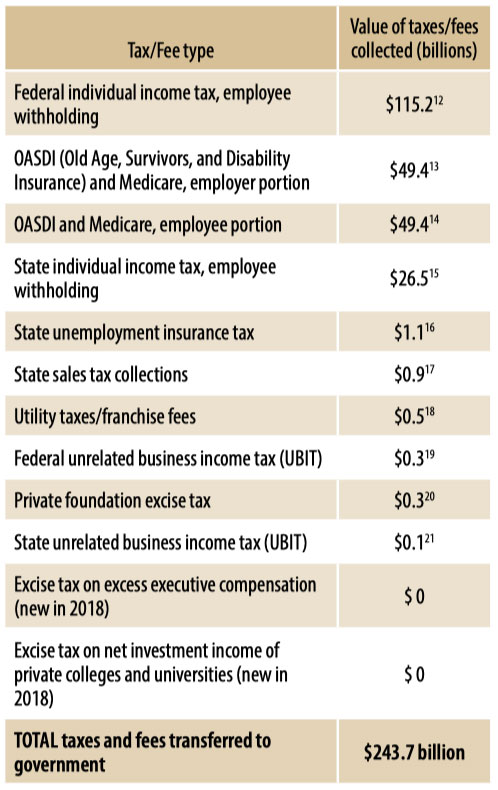

20 2019 the excise tax is 2 percent of net. Non-profit status may make an organization eligible for certain benefits such as. Yes nonprofits must pay federal and state payroll taxes.

Ad Improve Transparency and Reporting with Top Nonprofit Accounting Software. But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with. Tax treatment for non-profits.

Visit models resource center to compare analyze cutomize and follow portfolios. Nonprofit employees must pay state and federal taxes on earned income mirroring the. Bonfire Prints Ships Your Orders.

Organizations granted nonprofit status by the Internal. Top-Rated Accounting Software Designed For Nonprofits. Ad Powerful Fundraising Features for Nonprofits.

How Do Nonprofits Make Money Making Nonprofits Profitable Jitasa Group

What Is The New Markets Tax Credit And How Does It Work Tax Policy Center

Should Nonprofits Seek Profits

Nonprofit Law In India Council On Foundations

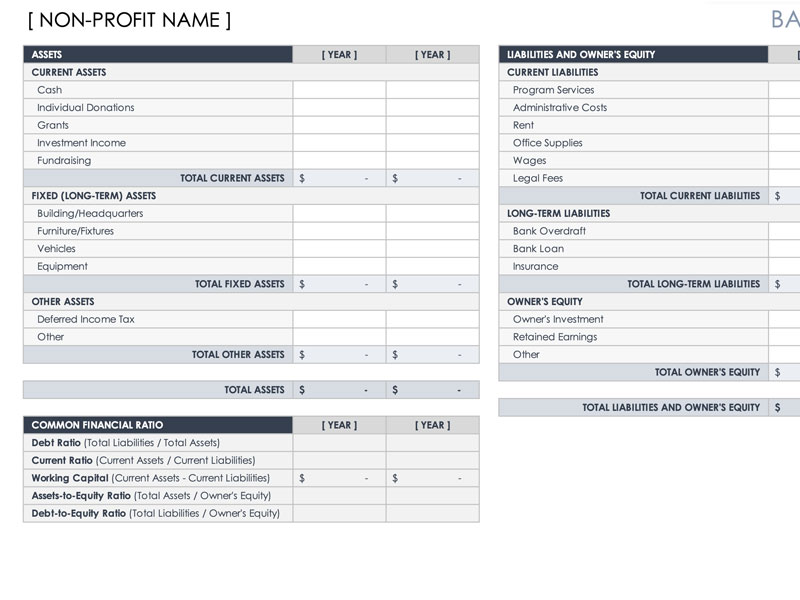

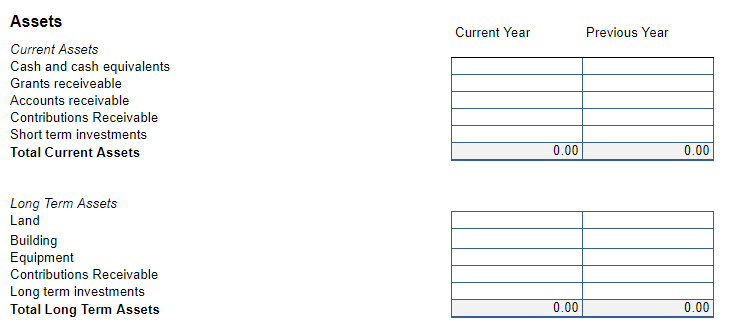

Non Profit Balance Sheet Template Excel Templates

Infinite Giving Nonprofit Investing The Ultimate Guide To Grow Your Giving

Nonprofit Accounting Explanation Accountingcoach

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Difference Between Nonprofit And Charity Difference Between

A Guide To Investing For Non Profit Organizations Round Table Wealth

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

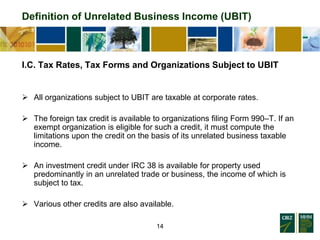

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

Are 501c3 Stock Investment Profits Tax Exempt Turbotax Tax Tips Videos

How Are Nonprofits Funded Knowledge Base Candid Learning

Understanding The 4 Essential Nonprofit Financial Statements

9 Ways To Reduce Your Taxable Income Fidelity Charitable

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

Double Taxation Of Corporate Income In The United States And The Oecd

Unrelated Business Income Tax Information For Charities Other Nonpr